With the arrival of summer, young people across the country are about to reach a key milestone: high school graduation. If you have a child claiming their diploma, now is the time to prepare them for life after leaving the nest.

Graduating from high school is a significant accomplishment. However, it comes with serious responsibilities that your child probably isn’t thinking much about right now. Once your child turns 18, they become a legal adult, and specific areas of their lives that were once under your control will be solely their responsibility.

While your child will now be a legal adult, you still have essential parental duties. Yet, if you don’t support your child in stepping into adulthood with legal documents to help both of you, it can be challenging and costly to help them in an emergency.

For instance, should your child get into a severe car accident and require hospitalization, you would no longer have the automatic authority to make decisions about their medical treatment or handle their financial matters. In fact, without legal documentation, you wouldn’t even be able to access his or her medical records or bank accounts without a court order.

To address this vulnerability and ensure your family never gets stuck in an unnecessary court process, have a conversation about estate planning with your kids before they move out or head off to college, and have them sign the following three documents.

01 | Medical Power of Attorney

The first document your child needs is a medical power of attorney. A medical power of attorney is an advance healthcare directive allowing your child to grant you (or someone else) the immediate legal authority to make healthcare decisions on their behalf if they become incapacitated and cannot make decisions themselves.

For example, the medical power of attorney would allow you to decide about your child’s medical treatment if they are knocked unconscious in a car accident or fall into a coma due to a debilitating illness.

Without a medical power of attorney in place, if your child suffers a severe accident or illness that requires hospitalization and you need access to their medical records to make decisions about their treatment, you’d have to petition the court to become their legal guardian. While a parent is typically the court’s first choice for a guardian, the guardianship process can be slow and expensive.

And due to HIPAA laws, once your child becomes 18, no one—not even parents—is legally authorized to access their medical records without prior written permission. However, an adequately drafted medical power of attorney will include a signed HIPAA authorization, so you can immediately access their medical records to make informed decisions about their treatment.

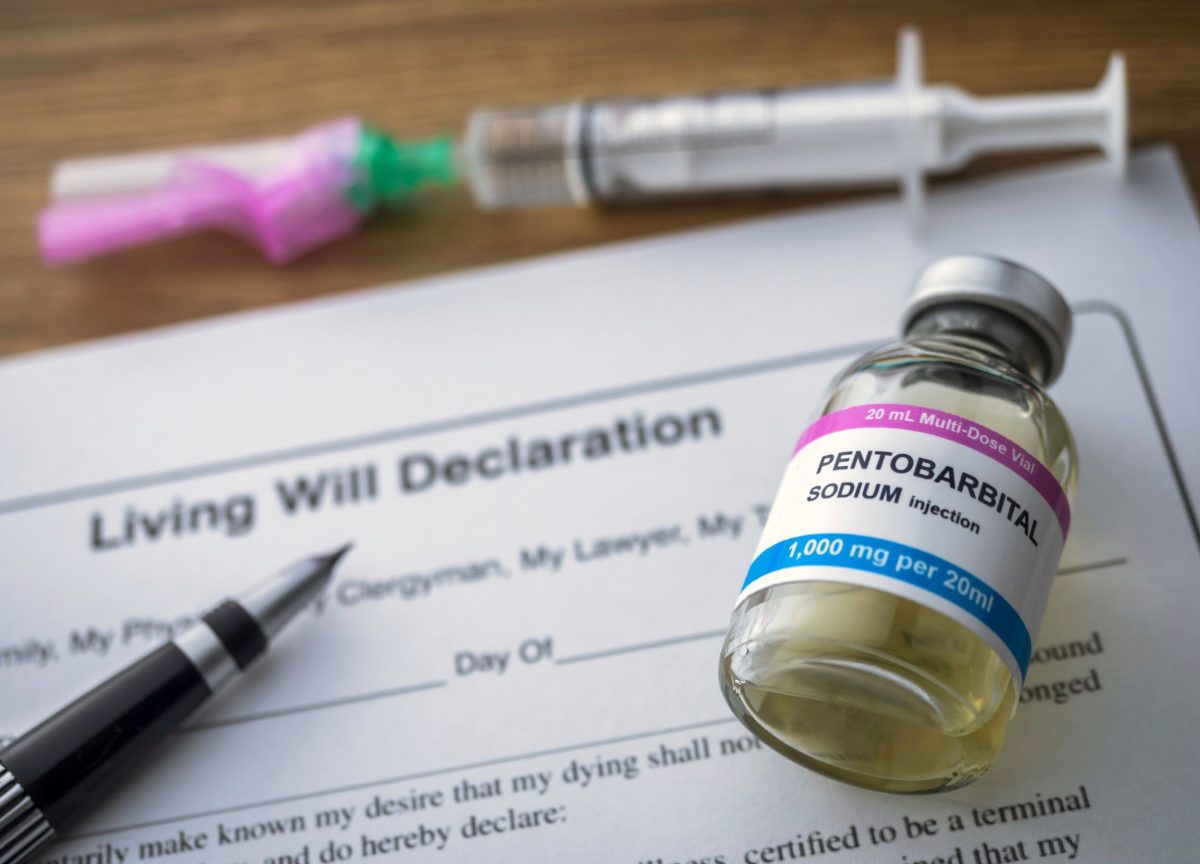

02 | Living Will

While the medical power of attorney allows you to make healthcare decisions on your child’s behalf during their incapacity, a living will is an advance directive that provides specific guidance. These are specifications on how your child’s medical decisions should be made, particularly at the end of life.

For example, a living will allows your child to advise if and when they want life support removed should they ever require it. In addition to documenting how your child’s medical care is managed, a living will also includes instructions about who should visit them in the hospital and even what kind of food they would want to have provided. For example, if your child is a vegan, vegetarian, gluten-free, or takes specific supplements, these are all things that should be considered and recorded in their living will.

03 | Durable Financial Power of Attorney

Should your child become incapacitated, you may also need the ability to access and manage their finances, and this requires your child to grant you durable financial power of attorney.

Durable financial power of attorney gives you the authority to manage their financial and legal matters, such as paying their tuition, applying for student loans, paying their rent, negotiating (or re-negotiating) a lease, managing their bank accounts, and collecting government benefits if necessary. Without this document, you must petition the court for such authority.

Start Adulthood the Right Way

Before your kids head out into the world, ensure they have the proper planning in place. By doing so, you are modeling good financial stewardship and setting them up immediately. Financial and legal illiteracy is an epidemic you can quickly address, starting with yourself and your family.

We can help you create these vital documents and facilitate a family meeting to discuss the importance of planning. We will begin what we hope will be a lifelong relationship with your children as they take this crucial first step into adulthood. Contact us today to get started.

This article is a service of August Law, a Personal Family Lawyer® Firm. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That’s why we offer a Life & Legacy Planning™ Session, during which you will get more financially organized than you’ve ever been before and make all the best choices for the people you love.

The content is sourced from Personal Family Lawyer® for use by Personal Family Lawyer® firms, a source believed to be providing accurate information. This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking legal advice specific to your needs, such advice services must be obtained on your own separate from this educational material.